Automotive

After the health crisis, governments launched massive investment plans to support the development of electric and hydrogen technologies and the associated infrastructure.

Several digital giants (e.g. Apple, Foxconn, Xiaomi) have confirmed the launch of their electric car projects. Today, Tesla’s stock market valuation exceeds that of all other manufacturers combined.

In order to remain competitive, traditional manufacturers and their suppliers are moving to control their value chain: relocation of strategic production (batteries, semi-conductors, etc.) and internalisation of software development related to smart mobility.

Market Trends

In order to meet the challenges of global warming, public health and reducing dependence on fossil energy resources, all mobility stakeholders are committed to hybrid, electric or fuel cell propulsion technologies.

According to the BCG, electrified vehicles could account for 50% of the world market share by 2030.

Challenges:

- Reduce the cost of electric power components

- Increase battery life and control battery supply

- Deploy recharging infrastructures and reduce recharging time

Artificial intelligence, the low cost of sensors and the development of new communications technologies (4G/5G, V2X…) have created a boom in advanced driver assistance systems (ADAS) and self-driving vehicles.

AD (Autonomous Driving) systems offer new opportunities in the passenger and goods transport market, which is 5 times more important than the automotive market.

Challenges:

- Allow the autonomous driving algorithm to cover as many situations as possible

- Prepare the individual for use based on a rethought ergonomics

- Prioritize new services related to autonomous transport

The growth in mobility in Asia, Latin America and the Middle East has reached the 100 million vehicles sold per year mark.

In the last 15 years, car sales in China have multiplied by 25, that is almost 25 million new vehicles in 2017, more than one third of the global market.

Challenges:

- Harmonize the logistics on the international scale

- Develop and use local industrial and R&D resources

- Anticipate rapid changes in these markets

Collecting data will make it possible to develop new services (insurance, parking, etc.), optimize R&D and production costs based on actual use by car drivers, or even implement predictive maintenance.

The market for collecting and using vehicle data could reach 33 billion dollars in 2025 compared to 2 billion in 2017.

Challenges:

- Protect personal data and car manufacturer data

- Exploit a large quantity of unstructured data

- Innovate in distribution and services in the automotive sector

ALTEN VALUE PROPOSITION

Functional sectors

covered by ALTEN

Systems and synthesis

Electronics and electricity

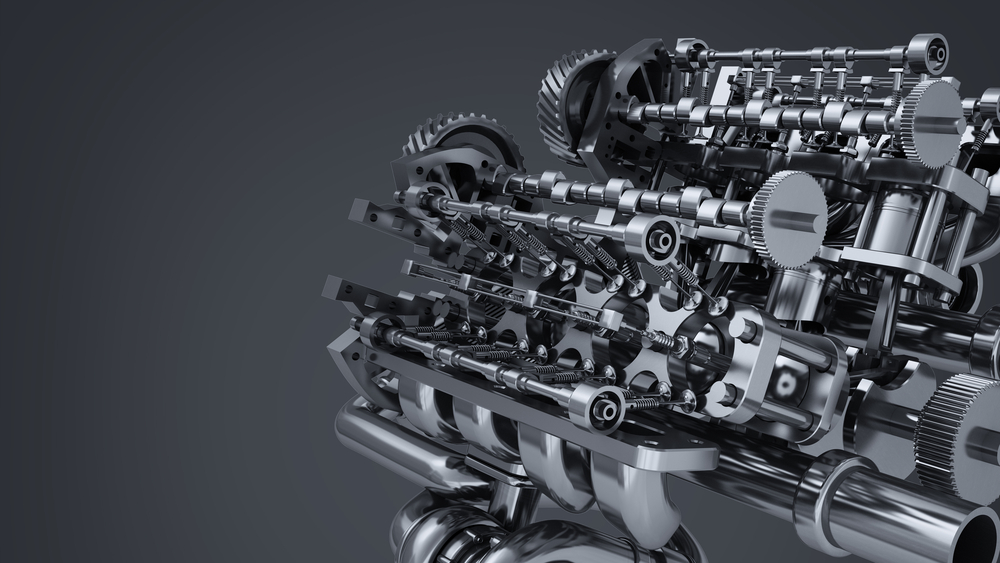

Powertrain

Chassis-Suspension

Equipped body

Process

Digital services

Our Success Stories

More than 1,200 ALTEN powertrain engineers are working on key innovations in the sustainable mobility sector, on behalf of top car manufacturers and automotive suppliers.

A premium British car manufacturer wanted to develop and produce a brand new family of compact, lightweight and low-emission petrol and diesel engines internally. To assist this project, ALTEN deployed more than 150 powertrain engineers to the United Kingdom within record time.

To launch its first level-4 autonomous vehicle, a French car manufacturer has to ensure its safety and robustness with regard to everyday traffic situations. ALTEN is assisting our customer in virtual based safety testing for self-driving vehicle.

Future autonomous vehicles will be based on ground breaking innovations coming into series during the next years. The world’s leading automotive safety component supplier and ALTEN are working hand in hand to ensure the development of one of the smallest integrated front camera based advanced driver assistance systems on the market.

车轻权重已经成为“名人老大哥est challenges faced by the automotive industry, with its impact on fuel economy and emissions, especially considering the new WLTP and RDE tests. ALTEN manages the whole vehicle weight balance process and controls, for two German major automotive manufacturers, over nearly all car lines.

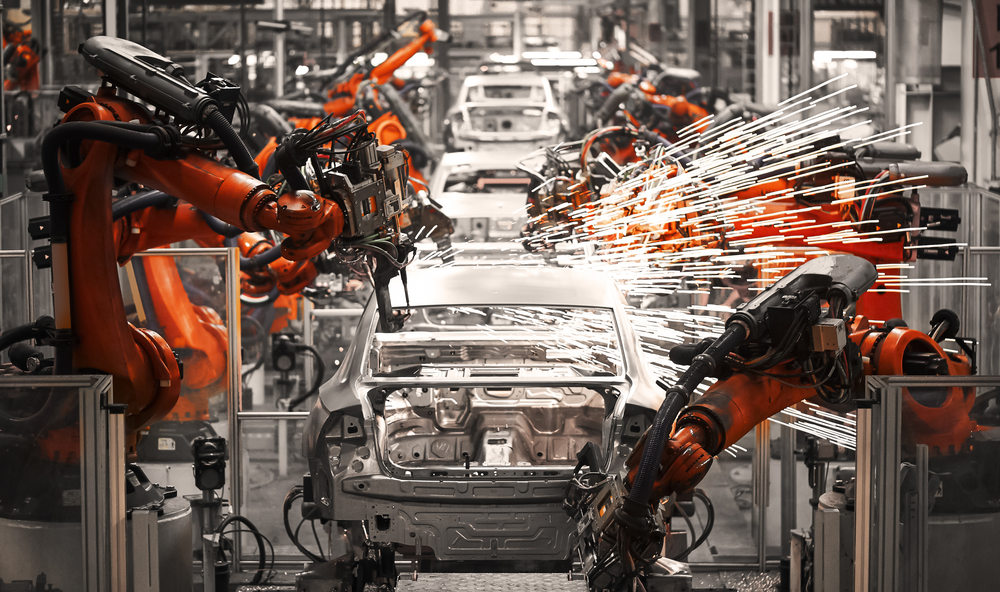

One of the world’s largest manufacturers of heavy-duty trucks invests several dozen of millions of dollars to upgrade its one million square-foot facilities in Pennsylvania (USA). XDIN USA, a subsidiary of the ALTEN Group, supports the customers to further improve manufacturing quality and efficiency.

OUR CLIENTS

Automotive manufacturer

Toyota, Ford, Volkswagen AG, Honda, BMW Group, Stellantis, Renault-Nissan, Volvo Group, Jaguar Land Rover…

Automotive Supplier

Bosch, Continental AG, ZF, Valeo, Faurecia, Aptiv, Autoliv…

Are you interested in the Automotive sector?

Join the ALTEN team and take part in the biggest technological challenges